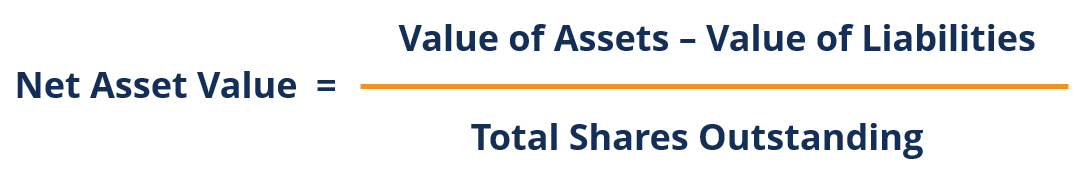

Net Asset Value

- Net asset value is true value

- Current market value of units

(Market value of investment + Asset -Liabilities )

- Asset - Dividend, Interest accrued

- Liabilities- Expanse

Sale Price

- Price at which AMC offer

- Sale price includes entry load

- NAV- Rs 10 , Entry load -Rs 2 , Sale price = Rs 12

- Entry load = sale price= NAV

- Entry load =0

- Sale price = NAV

Repurchase Price

- Price at which AMC redeem units

- Includes exit load

- NAV- Rs 10 , Exit load Rs-1

- Repurchase price = NAV -Exit Load

- Repurchase price=Rs 99

- Exit load= NAV - Repurchase price

Riskometer

Level of Risk

Low - Liquid or money market fund

Moderately Low -FMP / Capital protection oriented schemes / Ultra short term fund / Arbitrage fund

Moderate - Short term income fund / conservative monthly income plan / LT debt fund , LT gilt fund

Moderate High - Index fund / Balanced fund / Equity / Dividend yield fund

High - Sector & Focused equity fund

Dividend Distribution Tax

Individuals / HUF Corporate

Non Equity 25% 30%

Infrastructure 25% 30%

Debt Schemes 5% for NRI 30%

Thank you

For any information mail us - Info@licketysplit.in